After Congress passed the new Tax law in December, I began to wonder just how it would affect us here in our tiny enclave, on the edge of the “known world.”

Proponents crowed that a middle class family, making $90,000 a year, would get a $3,000 cut in their income tax.

$90,000 a year. We don’t make anything near that. Do you?

I started looking into it, and found some interesting information . . . .

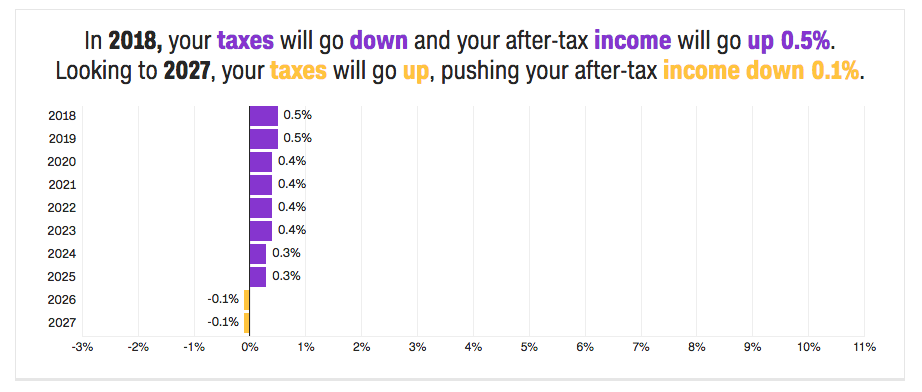

This is a screen shot of our results in the Tax Calculator (Image: Open Policy Center).

To start with, I found The Open Source Policy Center (OSPC) at The American Enterprise Institute, or AEI, a conservative-leaning Washington, DC-based think tank.

The OSPC contributes to an open-source tool, called Tax Calculator, developed by economists and contributors across the partisan divide that anyone can use to better understand tax policy.

The calculator is designed to see who would get a tax cut and who would see their tax bill go up. We plugged in a few numbers, and got the result in the image above.

They disclaim: “Of course, the results are grouped by demographic—not a reflection of any one tax return. The state and local taxes estimates are just that—estimates, based on IRS data. But what is revealed are the broad contours of a bill that creates clear winners and losers, especially across the income spectrum.”

I’m pleased to announce the release of More Calories Than Cash: Frugality the Zeiger Family Homestead Way. This short eBook—close to an ePamphlet—distills much of what this blog has to say on the subject of frugality up to this point, minus the section on Living Frugally in my previous book, Sacred Coffee: A “Homesteader’s” Paradigm.

At the moment, the new publication, More Calories Than Cash, is exclusive to our Website. You can’t buy it anywhere else on line. And, because it’s supposed to help save you money, we’re starting with the price: $1.99.

You can find it here. I hope it helps!